Customer Credit Transfer Initiation

The <pain.001> Customer Credit Transfer Initiation in the ISO 20022 Standard is the format for initiating payments. It enables corporate clients to submit payment orders accurately and efficiently to their bank using the large number of structured payment details supported.

SEPA

With SEPA (Single Euro Payments Area), standardised procedures for cashless payments were introduced across Europe, including in Germany. These procedures currently apply to euro payments in the 27 EU member states, the three other EEA member states – Iceland, Liechtenstein, and Norway – as well as Monaco, Switzerland, San Marino, Andorra, Vatican City, and the United Kingdom. From 5 October 2025, Albania, Moldova, Montenegro, and North Macedonia will also join the SEPA payment area. Payments, whether domestic or abroad, can be made via SEPA credit transfer, SEPA instant credit transfer, or SEPA direct debit.

SEPA is based on the ISO 20022 standard. In the XML format, the message type <pain.001> (CustomerCreditTransferInitiation) is used for credit transfers, while <pain.008> (CustomerDirectDebitInitiation) is used for direct debits.

The German Banking Industry Committee (DK) defines rules for populating the data formats in Appendix 3 of the Specification for Remote Data Transmission Between Customer and Bank According to the DFÜ Agreement. The most recent data formats are available on the EBICS (Electronic Banking Internet Communication Standard) website of the German Banking Industry Committee: https://www.ebics.de/de/datenformate.

Hybrid / semi-structured addresses (i.e. addresses that contain structured and unstructured elements) will be introduced in SEPA payment transactions from autumn 2025. For further details, please refer to the information under Cross-Border Payments.

The latest SEPA LifeCycle and SEPA format versions supported by DZ BANK can be found at: https://www.ebics.de/de/datenformate/format-lifecycle.

Further information about SEPA payments is available at: https://firmenkunden.dzbank.de/content/firmenkunden/de/homepage/leistungen/Zahlungsverkehr/zahlungen_in-_und_ausland/sepa-zahlungsverkehr.html.

Cross-Border Payments

Significant changes are imminent for cross-border payments, as financial message formats are globally standardised through the migration to ISO 20022. This migration, which began in Europe with SEPA, will now be rolled out worldwide, paving the way for a unified, global payments messaging standard.

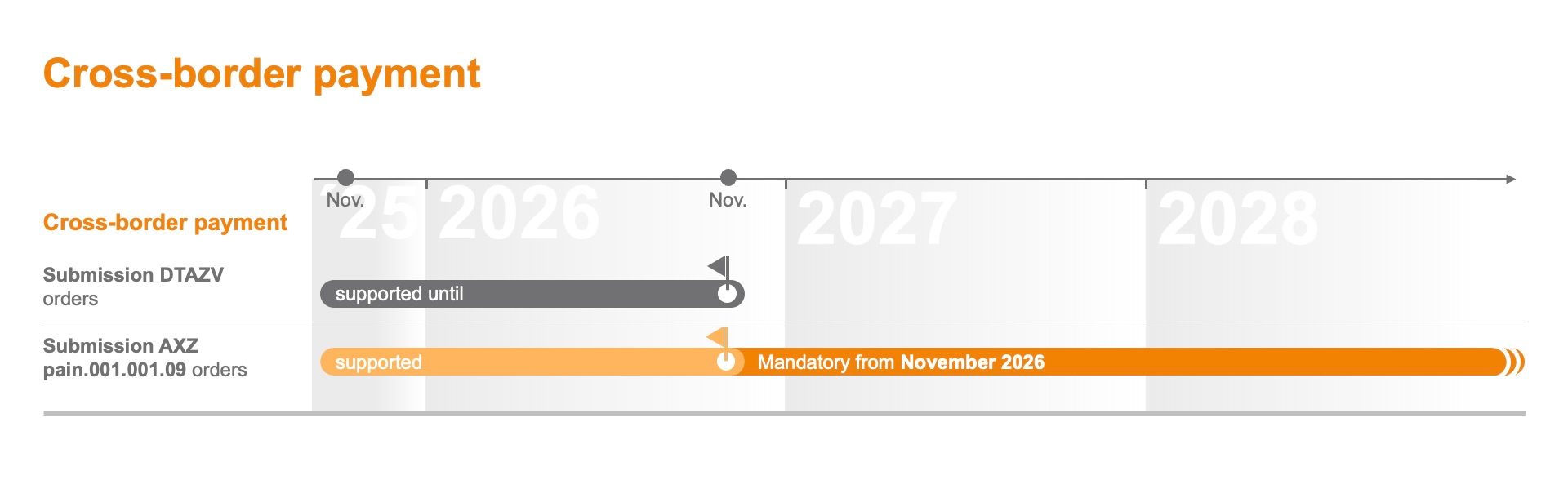

In this process, the traditional DTAZV customer format will be discontinued. It will be replaced by the ISO 20022 <pain.001> message format, marking the end of the last entirely national data format in the German payments sector.

The new format offers significantly more functionality and flexibility, such as the ability to include a unique payment reference and structured address data when initiating a payment.

The German Banking Industry Committee (DK) has fixed the ISO 20022 <pain.001.001.09> message type for submitting cross-border payments. The applicable DK standard is outlined in Appendix 3 of the Specification for Remote Data Transmission Between Customer and Bank According to the DFÜ Agreement, Chapter 3.1 “Cross-Border Payment Transactions Based on ISO Standard 20022”, and in the supplementary guidelines of the DZ BANK product specification.

The order type (which corresponds to the current Business Transaction Format (BTF) parameters) <AXZ> has been introduced for transmitting <pain.001.001.09> orders via EBICS. You can request us to activate this order type for you at any time.

The general data format specification and related resources are available at: https://www.ebics.de/de/datenformate.

To ensure a timely transition from the DTAZV format to the <pain.001.001.09> format for cross-border payments, you will need to make changes to your software products and ERP systems. Please contact your relevant vendors for this in good time.

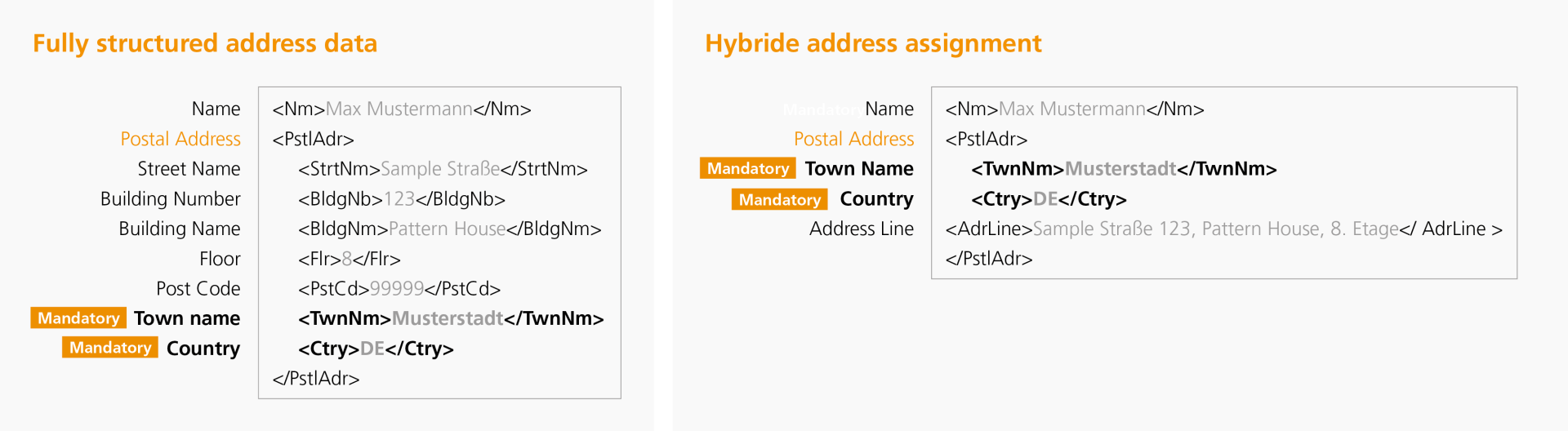

As before, address details for the parties involved must be provided for payments of a cross-border nature. In contrast to the current DTAZV format, the new <pain.001> format uses structured address data only. This means that each element of the address is specified in a designated field. Using German addresses as an example, the payer’s name, street name, house number, postal code, city, and country are each entered in their own dedicated field.

Due to new international requirements, purely unstructured address information will no longer be accepted from November 14, 2026. To ensure smooth and swift processing of your cross-border payments in the future, address data must be transmitted in a structured or hybrid format.

Migration timeline

| Date | Milestone |

|---|---|

| 22 November 2025 | Hybrid postal address becomes available |

| 14 November 2026 | Fully unstructured addresses no longer accepted (end-date) |

We support you in the transition and offer the following options:

Fully structured address data (recommended): All address data (name, street, house number, postal code, etc.) are provided by you in structured form in the designated, separate fields. This ensures the most efficient processing.

Semi-structured (hybrid) address assignment: This format combines mandatory structured fields (city and country) with unstructured additional information (AdrLine). In the AdrLine field, supplementary details may be entered in an unstructured way (e.g., street and house number). When using the hybrid address format, only two AdrLine lines are permitted.

Your next steps: Providing correct address data is essential for cross-border payment orders.

- Review and assess your existing payment initiation systems and data formats

- Ensure that all postal addresses provided for the Debtor and Creditor are submitted using either the fully structured or hybrid format, at least a structured Town Name and a structured Country Code.

- If your records do not currently include the Town Name and Country Code for these parties, please prioritize reaching out to your payees and begin collecting this information as soon as possible.

- Plan to migrate your payment initiation to the fully structured or semi-structured format by November 14, 2026 at the latest.

For the highest processing quality, we recommend submitting fully structured addresses.

It is already possible to submit cross-border payments to DZ BANK in <pain.001.001.09> format. During the transition period, which ends in November 2026, you will be able to use both formats (DTAZV and <pain.001 AXZ>) for submitting cross-border payments.

Relay message – Request for Transfer (MT101)

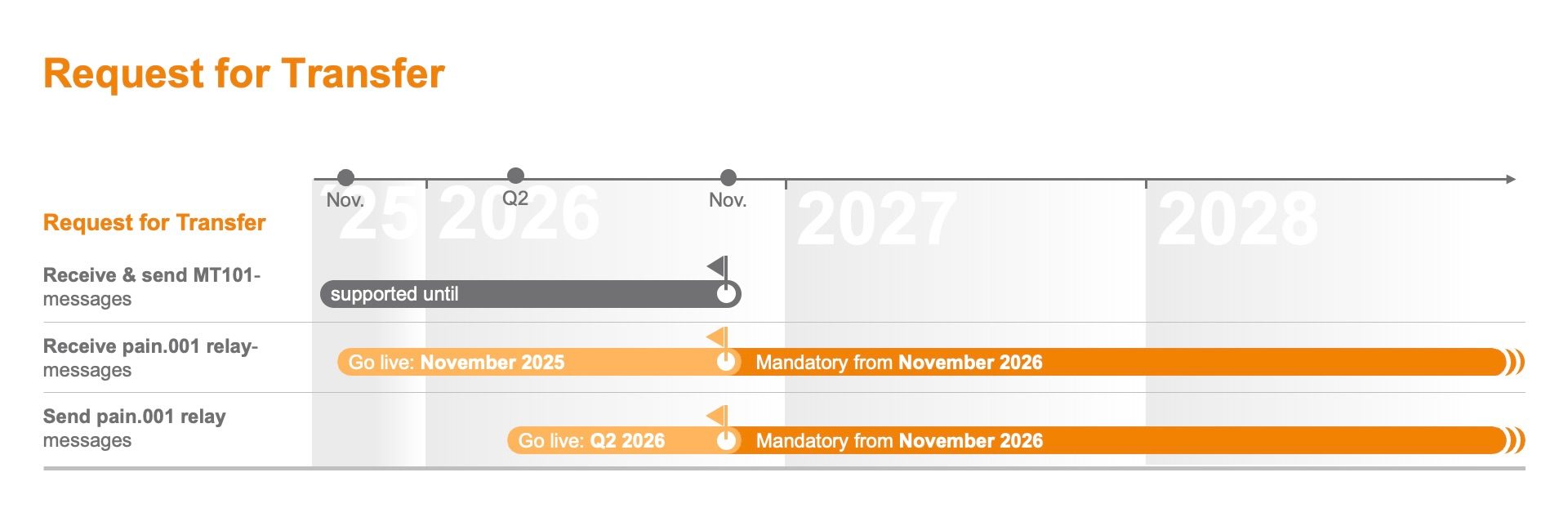

In addition to cross-border payments, changes are also impending for the cross-border forwarding – or relay – formats. The long-standing SWIFT <MT101> customer format will be replaced by the ISO 20022 <pain.001 relay> message format.

The new format offers significantly more functionality and flexibility. Its richer, structured information content facilitates the automated validation of payments in your systems, thereby reducing the need for manual intervention.

Adapting to the new format during the migration will require changes both to the processing systems and their interfaces. At the same time, however, it allows you to work with a wider range of better structured payment transaction data.

The new, internationally binding requirements for address data are a key driver of this change.

We recommend planning your transition to the future-proof pain.001 format as soon as possible. Please contact your relevant vendors for this in good time.

If you are a bank that exchanges transfer requests (Requests for Transfers) with us on behalf of corporate customers, further information is available for you here.

From November 2025, the <pain.001.001.09 relay> format will gradually begin replacing the existing SWIFT <MT101> format in full.

The order type (which corresponds to the current Business Transaction Format (BTF) parameters) <RTX> has been created for transmitting <pain.001.001.09 relay> files via EBICS. We will notify you as soon as this order type becomes available.

A data format specification and related resources will be published shortly on this page under “Downloads”.

A general specification of cross-border formats is also provided in the German Banking Industry Committee (DK) guidelines, available at: https://www.ebics.de/de/datenformate/internationale-datenformate.

Adapting to the submission of Request for Transfer in the new <pain.001.001.09 relay> format will require changes to your software products and ERP systems. Please contact your relevant vendors for this in good time.

Notes on the MT101 legacy format

Continued use of the MT101 format is no longer recommended after the migration phase, as it only provides limited support for the new international requirements for structured address data. This could result in operational risks, such as payment delays or rejections.

From November 14, 2026, relay messages will also require structured address data. Unstructured addresses will not be accepted after this date. The pain.001 format supports the transmission of fully structured and hybrid address data. To ensure smooth processing, we recommend using this format. For details on the structured address data, please refer to the 'Cross-border payments' section.

DZ BANK will be able to receive the new <pain.001 relay> format from third-party banks on your behalf, starting in November 2025.

The introduction of <pain.001.001.09 relay> to replace <MT101> for submissions to third-party banks is scheduled for the beginning of 2026.

DZ BANK plans to continue supporting the <MT101> format until November 2026. During the transition period, you will be able to submit Request for Transfer using either the <MT101> or <pain.001 relay> format.